Introduction

The company is able to advise companies conducting exploration and production operations and is able to make complete assessments for all stages of oil and gas exploitation including exploration, appraisal, development, production and abandonment.

Overview

Team of internationally focused consultants able to be deployed to answer detailed questions associated with prospect evaluation, reserves determination and field development planning. The team comprises subsurface and surface technical specialists along with economists who are able to provide a robust fully integrated solution for any hydrocarbon field development.

Primary focus is:

• Perform Independent Resource Determinations – to PRMS and other internationally accepted standards.

• Develop Integrated Reservoir Models based on geophysical, geological and reservoir engineering analysis supported by relevant software.

• Generate Field Development Plans including the integration of all technical and economic aspects to provide an optimised solution.

• Develop Independent Oil and Gas Project Costs Estimates, Verifications and Audits

Integrated Geological and Reservoir Modelling for oil, non-associated gas and gas condensate fields. Company use industry leading software to carry out this work have extensive experience in assessing both sandstone and carbonate reservoirs. Company has developed such models for relatively small through to super giant fields.

Field Development Planning at feasibility study, conceptual and detailed level. Company starting point for this tends to be from the subsurface based on reservoir modelling but company are also able to assess surface facilities to provide fully optimised plans.

Cost Assessment including indendent estimates, verifications and audits. Company expertise in this subject is increasingly being called on by Clients to provide robust independent verification of their own project cost estimates.

Also Company have extensive experience in Ultra Deepwater Blocks for Integrated Studies covering all the aspects i.e.: G&G and Reservoir modelling to Field Development Planning, Cost and techno – commercial evaluation

In India Company have worked lots for ONGC, OIL, ONGC Videsh, Jindal Petroleum, Cambay Petroleum etc…

The primary activity of group is the implementation of consultancy services in these areas

• Licensing and Prospect Evaluation

• Reserves Determination, Verification, Certification and Valuation

• Integrated Reservoir Studies

• Field Development Planning

• Due Diligence & Legal Support Services

• Project Cost Estimations and Vetting

Much like an oil company, INTEGRATED TEAM of geophyscists, geologists, reservoir engineers, facilities engineers, cost engineers and economists to provide a complete answer to a client requirement; be that:

• Assessment of an Exploration License for a buyer

• An INDEPENDENT Reserves Determination for a Financing or Acquisition

• Generation of a Field Development Plan for Exploitation of a Property

• Preparation of a Property for sale and engagement in negotiation of sales agreements

• Implementation of a Basin Study

• Or any other techno-economic oil and gas issue

In addition to the services listed above company is able to provide financial and legal support through:

• Providing Technical Support to Partners

• Providing technical Due Diligence in acquisitions

• Developing Competent Person Reports for Stock Exchange Listings

• Developing Petroleum Expert Witness Reports for Legal Disputes

• Carrying out Technical and Financial Audits and Monitoring

• Conducting Technical and Financial Risk Analysis

Company is able to provide full, independent analysis of oil and gas reserves of any size from seismic assessment and interpretation through geological model development and reservoir simulation, field development planning and economic assessment.

In carrying out reserves assessments and certifications, company tend to adopt the rules and standards set down by the internationally recognise Petroleum Resource Management System (PRMS)1. This system allows not only the certification of reserves – that is hydrocarbon recoverable from discovered fields, but also resources – that is hydrocarbon that may be recovered from discovered sub-commercial accumulations in the future or prospective structures indicated by seismic assessment and other geological analysis, but which have yet to be drilled. The PRMS will establish the following reserves and resource structure for each license evaluated:

Clearly any reserves assessment will be carried out using data made available by the operator of the field.

Whilst the PRMS is the system that they would tend to adopt company is able to certify reserves and resources for a number of other regimes including:

• Securities and Exchange Commission (SEC)

• Russian Standards (used by the countries in the Former Soviet Union)

• Petroleum Resources Management System sponsored by the Society of Petroleum Engineers (SPE),

• American Association of Petroleum Geologists (AAPG), World Petroleum Council (WPC) and Society of Petroleum Evaluation Engineers (SPEE).

Rules set by various stock exchanges around the world including:

• Toronto Stock Exchange (TSX)

• London Stock Exchange (LSE)

• Johannesburg Stock Exchange (JSE)

• Alternative Investment Market (AIM)

Stock Exchanges around the world tend to adopt similar rules systems for reserves determinations which allows us to have a global reach.

Analytical Resources

The company occupies modern offices, owns several 64 Bit workstations, one large format printer and several high quality colour printers. It also has software licenses for key geological, reservoir and process evaluation software including:

• The Kingdom Suite – Seismic Interpretation and well data analysis

• IRAP RMS – 3D geological modelling

• Petrel - 3D geological modelling

• ArcGIS - geographical mapping and information systems

• Eclipse Black Oil– reservoir modelling

• Eclipse Multi-component – reservoir modelling

• Powerlog – petrophysical and well log analysis

• ProMAX – process simulation

• NetCo$ter - Cost Estimation

• Crystal Ball – probabilistic assessment

Recent Project Experience includes: Super Giant Carbonate fields, Highly Sour, Giant Gas fields, Larger Ultra Deep water License Area, Very Large Post-Salt Clastic Structures, Heavy Very Viscous Oil in shallow Marine sandstones.

Some Recent Projects are: KG Basin Deepwater India: Third Party Evaluation of Field Development Plan (FDP) of Deepwater block several oil & gas and non-associated gas fields located in deepwater of KG basin, evaluation considered all aspects of the development including reserves, development cost, operating cost and economic performances. Also; Critical review of the subsea developments and petro physical assessment performed by the company.

Mumbai High Field - Offshore: Peer Review of Conceptual Report (CR) & Field Development Plan (FDP) of Mumbai High reviewed the available technical data and held consultation workshops with the Client. The review considered subsurface issues, drilling, subsea engineering, facilities engineering, HSE and economics. The ultimate product of the work was a peer review that critiqued the Client’s designs, practices and which made suggestions for improvement. A key issue was ensuring that good practice had been adopted during all stages and areas of the design and plan.

KG Basin India: Reserves Certification Report Non-associated Gas Field

Mumbai High India: Cost Audit Offshore Field Development Plan, India

Kashagan Field: Built a fully functioning reservoir model of the supergiant Field based on seismic, well and other available data. then went on to provide independent opinion on field development planning including: optimum production scheme – subsurface and surface, reserves, production profiles, recovery and well configuration.

Niger Delta: Developed an independent resource assessment for an ultra deep water license. Established 1P and 2P reserves, contingent resources and prospective resources. Developed a valution for the reserves associated with the property.

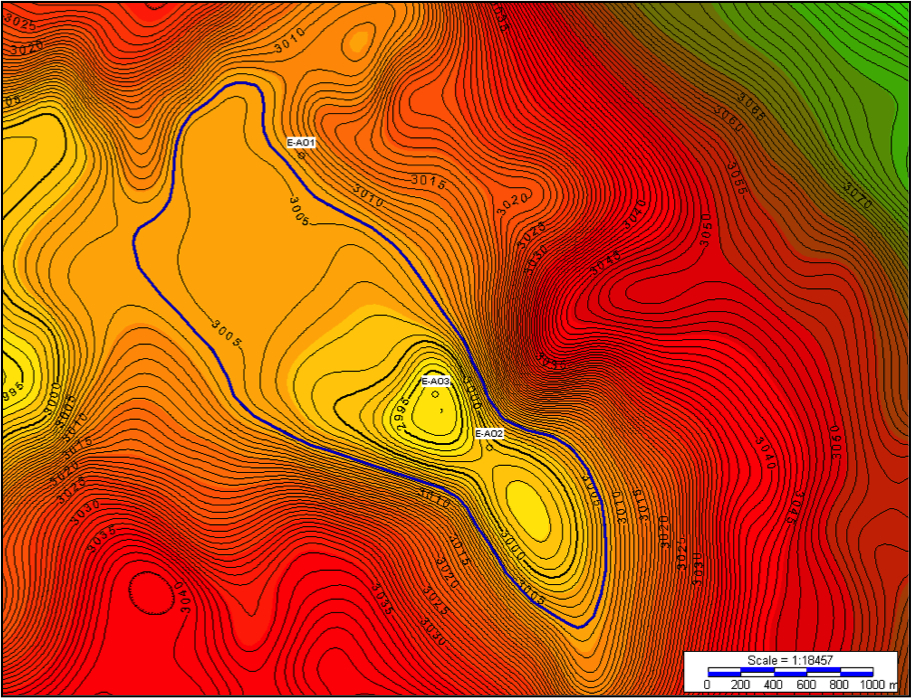

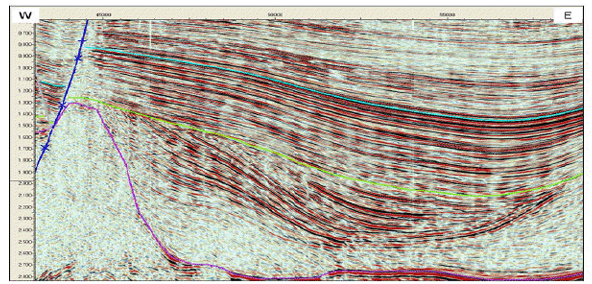

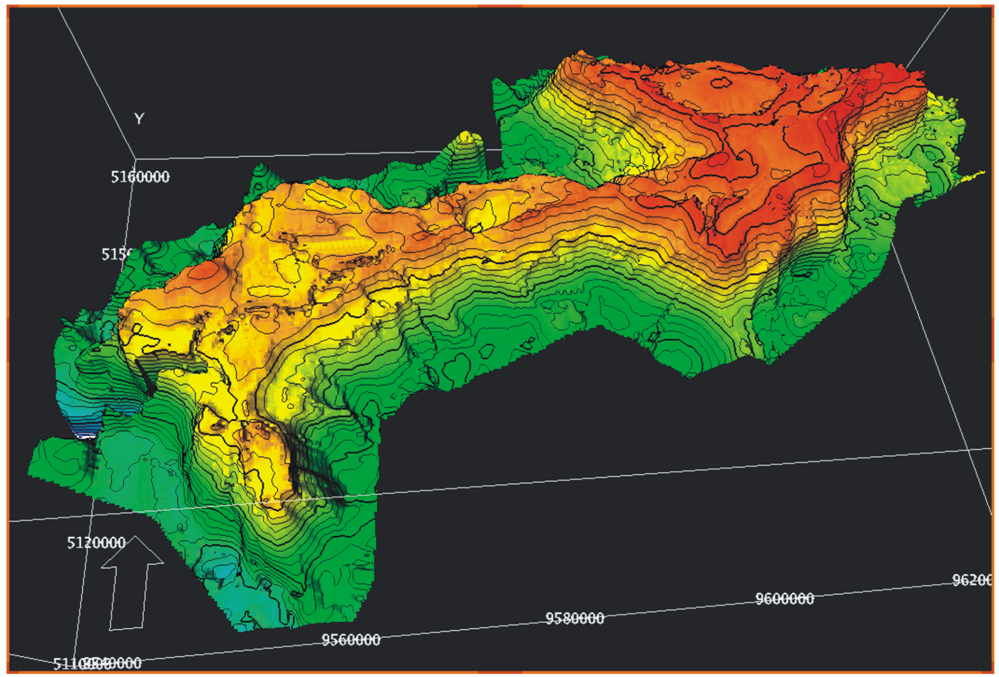

Gurney-Kirtepe - Karacan Fields: Developed a fully integrated geological and reservoir simulation model for the field. Including interpretation of a 3D seismic data set, development of a static geological model and a dynamic

reservoir model. Also carried out fracture analysis on this Carbonate to establish as complete a model as possible.

Cost Verification – NW Gemsa: carried out a cost assessment and verification on annual budgets submitted to our Client a partner in the concession. Checked that costs charged met industry norms and developed a critique for use in by the Client in project budget meetings.

Verification - Cost Estimating Methodology for Offshore Projects – for Indian E&P Company

Contracted to validate a cost estimating methodology developed by the Client for Wellhead and Processing Platforms and Pipe Line installations to be added to its existing core production area in the Mumbai High Field. The cost estimating method was vetted along with the rates its used to ensure it reflected current market conditions. Following validation we were provided with a watching brief designed to monitor cost rates and update the methodology on a quarterly basis.

Offshore Tunisia: Developed an independent probabilistic resources and reserves assessment for an offshore block in Tunisia in accordance with the PRMS standard. Also carried out a valuation of the block for potential equity purchase by the Client

Kosmos License: Developed independent probabilistic resources and reserves assessment for this offshore block in Tunisia in accordance with the PRMS standard. Also carried out a valuation of the block for potential equity purchase by the Client. This information statement provides subsections on our capability, personnel, analytical resources and past experience.

Few Projects Examples:-

• G&G Team – Eastern Europe – Geophysical Assessment, Seismic Survey Planning and Implementation, Exploration Drilling Planning

• Resource Determination – Nigeria – Reserves Determination and Valuation, and Prospectivity Assessment for Ultra Deep License Area

• B8 Field – Baltic Sea

– Reserves Determination to PRMS Standards, Valuation and Conceptual Field Development Plan

• Skarv Field – Norway

– Reserves Verification to PRMS and Norwegian Standards, Cost and Schedule Risk Assessment

• Sakhalinsky and Prirechnoye – Ukraine

– Reserves Determination to PRMS Standard and Purchase Valuation

• Competent Person Report Licenses – DR Congo

– Developed CPR to JSH rules for two Exploration License Areas in Albertine Basin

• Block 3A Buyers Report – Kazakhstan – Resource Determination PRMS Standard and Valuation of License Area

• Prospectivity Evaluation – Offshore Ghana – Development of Play Concepts, Prospectivity Evaluation and Exploration Plan Development

• Farm-in Assessment 4 Producing Properties – Kazakhstan – Reserves Verification to PRMS standard, Field Development Plan Verification and Valuation

• Okoro and Setu Fields Financing – Offshore Nigeria – Reserves PRMS Development Planning Risk Assessment 3 Verification to standard and

• Bab and Shah Field – Abu Dhabi – Reserves Determination to PRMS Standard, Conceptual Field Development Plan and Valuation

Oil & Natural Gas Corporation Ltd (ONGC)

Oil India Ltd (OIL)

Directorate General of Hydrocarbons India (DGH)

Indian Oil Corporation Ltd (IOCL)

Hindustan Petroleum Corporation Ltd (HPCL)

Bharat Petroleum Corporation Ltd (BPCL)

GAIL (India) Ltd

Cairn India Ltd

Gujarat State Petroleum Corporation Ltd (GSPC)

BG Exploration & Production India Ltd (BGEPIL)

Reliance Industries Ltd (RIL)

National Fertilizer Ltd (NFL)

Indian Farmers Fertiliser Cooperative (IFFCO)

Brahmaputra Valley Fertilizer Corporation Limited (BVFCL)

Gujarat Narmada Valley Fertilisers & Chemicals Limited (GNFC)

Engineers India Ltd (EIL)

Projects & Development India Ltd (PDIL)

Tractebel India

Mecon Ltd

L&T Hydrocarbons

Punj Lloyd

SAIL India Ltd

NALCO

Email : sales@billmarketing.com